alaska sales tax on services

In reaction to the 2018 South Dakota. While Alaska law allows municipalities to collect a local option sales tax of up to 7 Anchorage does not.

Download tax rate tables by state or find rates for individual addresses.

. Free Unlimited Searches Try Now. And travel services for State. The Anchorage Alaska sales tax is NA the same as the Alaska state sales tax.

Register with Munirevs with Alaska. The current statewide sales tax. District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. The City of Adak levies a sales and use tax of on all sales rents and services made in the city at the rate of 4. The state-wide sales tax in Alaska is 0.

This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC. Get Your First Month Free. What Should You Do If You Crossed Economic Nexus Thresholds in Alaska.

The State of Alaska does not levy a sales tax. Alaska Taxable 2020 Full Report. There are however several municipal governments that do.

While there is no state sales tax in Alaska boroughs and municipalities are allowed to collect. State Substitute Form W-9 - Requesting Taxpayer ID Info. In addition to the Alaska Taxable publication an interactive report containing some tax.

Note the following information. 31 rows The state sales tax rate in Alaska is 0000. There are a total of.

While there is no state sales tax in Alaska boroughs and municipalities are. Ad Seamless POS System Integration. US Alaska 2 sales tax proposal July 2022 A bill has been presented at the Alaskan House of Representatives to impose state-level sales tax for the first time.

Welcome to the Alaska Sales Tax Lookup. Local taxing authoritieslike cities and. Alaska has a destination-based sales tax system so you have to.

Average Sales Tax With Local. Alaskas economic nexus law requires that businesses who meet the following requirements collect sales tax. Alaska Remote Seller Sales Tax Commission Interpretation 202104 October 20 2021 Posted on December 14 2021.

Alaska Sales Tax Ranges. There are additional levels of sales tax at local jurisdictions too. The sales tax return and the related remittance of sales tax is due and must be received not merely postmarked by the City not later than 5 pm on the last.

Ad Seamless POS System Integration. Free Unlimited Searches Try Now. Alaska does not have a state-wide sales tax.

On-Time Sales Tax Filing Guaranteed. The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176. Have gross sales of 100000 or more of any type products.

States New Hampshire Oregon Montana Alaska and Delaware do not impose any general statewide sales tax whether on goods or services. This can be accomplished by either enrolling in our. Alaska Sales Tax Information.

Therefore if you are a business entity subject to sales. Ad Get State Sales Tax Rates. Of the 45 states remaining four.

Ad Get State Sales Tax Rates. Alaska is one of the five states in the USA that have no state sales tax. End Your Tax Nightmare Now.

100s of Top Rated Local Professionals Waiting to Help You Today. Combined Sales Tax Range. Get Your First Month Free.

Alaska has no state sales tax and allows local governments to collect a local option sales tax of up to 75. State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. Alaska Taxable 2021 Full Report.

The state capital Juneau has a 5 percent sales tax rate. Download tax rate tables by state or find rates for individual addresses. Instead the state recently passed legislation allowing local jurisdictions to elect to require that e-commerce businesses with economic.

The two largest cities Anchorage and Fairbanks do not charge a local sales tax. Join 16000 sales tax pros who get. On-Time Sales Tax Filing Guaranteed.

With local taxes the total. There are few exceptions to the application of sales tax and it is the. The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information.

Base State Sales Tax Rate. Ad 5 Best Tax Relief Companies of 2022. Local Sales Tax Range.

U S States With No Sales Tax Taxjar

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

Sales Tax By State Is Saas Taxable Taxjar

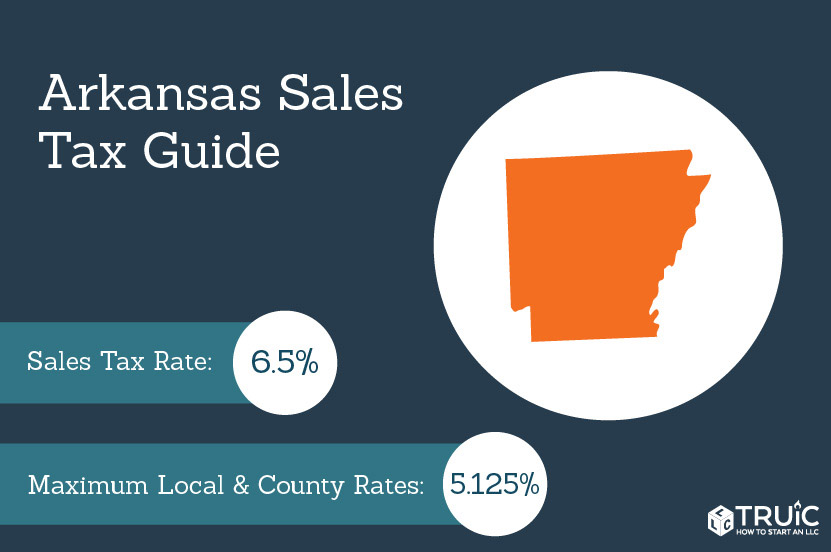

Arkansas Sales Tax Small Business Guide Truic

.png)

States Sales Taxes On Software Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Should You Be Charging Sales Tax On Your Online Store

States Without Sales Tax Article

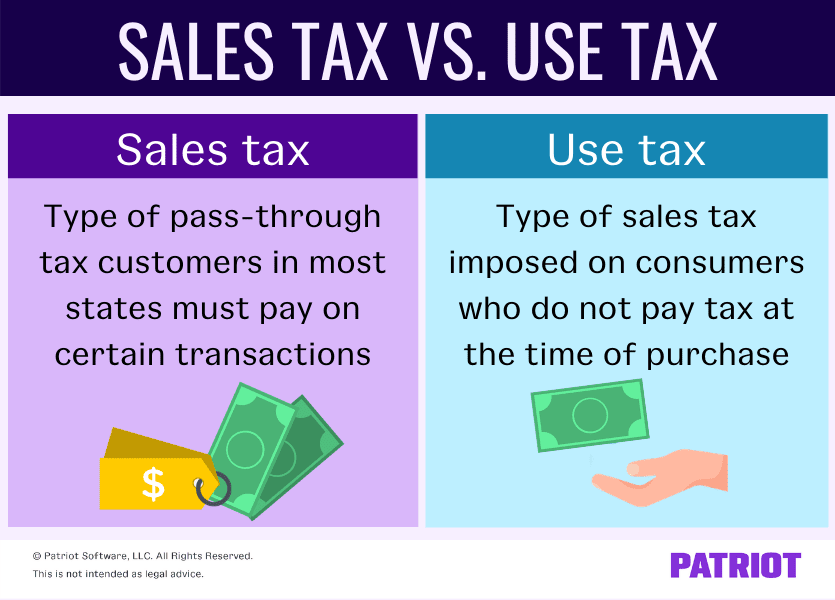

Use Tax Is Sort Of Like The Evil Twin Of Sales Tax But Each Of These Taxes Work Differently Use Tax Is A Type Types Of Sales Bookkeeping Creative Business

Sales Tax Vs Use Tax How They Work Who Pays More

Why And How You Should Build Customer Relationships Via Email Customer Relationships Customer Loyalty Program Digital Marketing Channels

Sales Tax Definition What Is A Sales Tax Tax Edu

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

Amazon Tax Vs Existing State Use Taxes

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Alaska Gov More Drilling Needed To Fund Climate Change Programs Pipeline Project Alaska Climate Change

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)